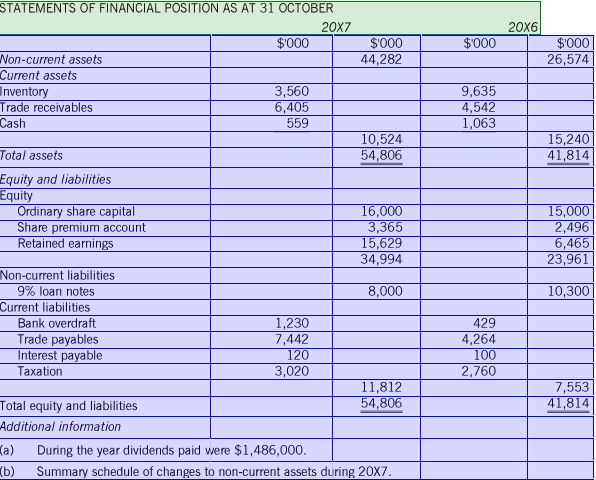

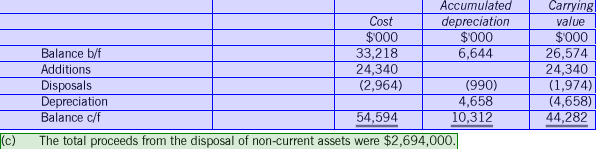

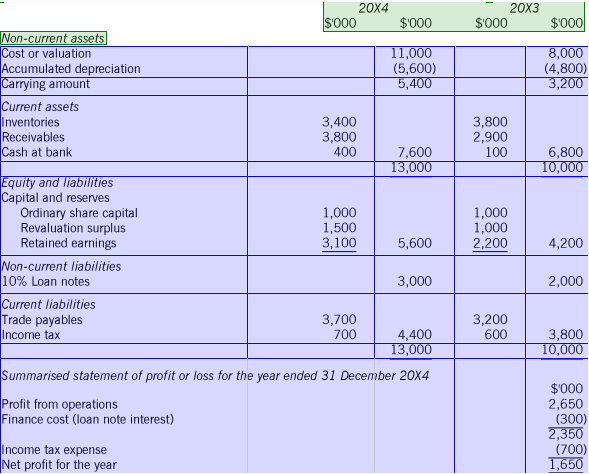

The following information is available for Sioux, a limited liability company:Statements of financial position

1?During the year non-current assets which had cost $800,000, with a carrying amount of $350,000, were sold for $500,000.

2?The revaluation surplus arose from the revaluation of some land that was not being depreciated.

3?The 20X3 income tax liability was settled at the amount provided for at 31 December 20X3.

4?The additional loan notes were issued on 1 January 20X4. Interest was paid on 30 June 20X4 and 31 December 20X4.

5?Dividends paid during the year amounted to $750,000.

Prepare the company's statement of cash flows for the year ended 31 December 20X4, using the indirect method, adopting

the format in IAS 7 Statement of cash flows.