快速查題-ACCA英國注冊會計師試題

ACCA英國注冊會計師

篩選結(jié)果

共找出60題

- 不限題型

- 不定項選擇題

- 單選題

- 填空題

- 材料題

- 簡答題

- 論述題

A firm has to pay a 20c per unit royalty to the inventor of a device which it manufactures and sells. How would the royalty charge be classified in the firm's accounts?

Which of the following would be classed as indirect labour?

A manufacturing firm is very busy and overtime is being worked. How would the amount of overtime premium contained in direct wages normally be classed?

A company makes chairs and tables. Which of the following items would be treated as an indirect cost?

The following data relate to two output levels of a department:

Machine hours???????????????????????? 17,000??????????????????????? ?18,500

Overheads???????????????????????????????$246,500???????????????????? $251,750

What is the amount of fixed overheads?

??? $? O

P Harrington is a golf ball manufacturer. Classify the following costs by nature {direct or indirect) in the table below.

??????????????? Cost??????????????????????????????????????????? ?? Direct????????? ???????? Indirect

Machine operators wages??

Supervisors wages??

Resin for golf balls??

Salesmen's salaries??

George pic makes stationery. How would he classify the following costs?

Cost???????????????????????????????????????????????????? ???????? Production???????????????????? Administration???????????????????? ?Distribution

Purchases of plastic to make pens???

Managing director's bonus???

Depreciation of factory machinery???

Salaries of factory workers??

Insurance of sales team cars???

Camberwell runs a construction company. Classify the following costs by nature (direct or indirect) in the table below.

Cost????????????????????????????????????????????????????????????????? Direct???????????????? Indirect

Bricks??

Plant hire for long term contract??

Builders' wages??

Accountants' wages??

材料全屏

56

【單項選擇題】

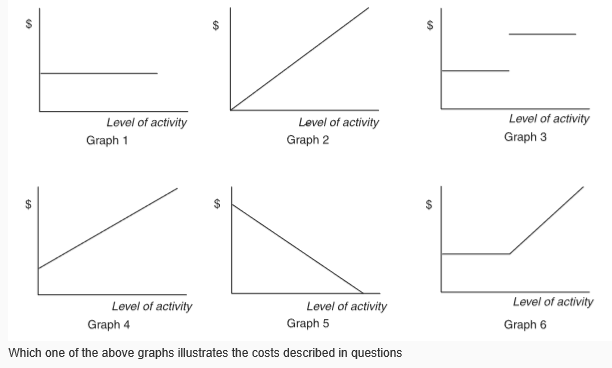

A linear variable cost - when the vertical axis represents cost incurred.

A fixed cost - when the vertical axis represents cost incurred.