快速查題-ACCA英國注冊會計師試題

ACCA英國注冊會計師

篩選結(jié)果

共找出60題

- 不限題型

- 不定項選擇題

- 單選題

- 填空題

- 材料題

- 簡答題

- 論述題

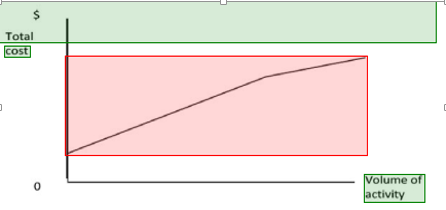

A linear variable cost - when the vertical axis represents cost per unit

A semi-variable cost - when the vertical axis represents cost incurred.

A step fixed cost - when the vertical axis represents cost incurred.

The following diagram represents the behaviour of one element of cost:Which one of the following descriptions is consistent with the above diagram?

An organisation has the following total costs at three activity levels:

Activity level (units)????????????? 8,000??????????????? 12,000???????????????? 15,000

Total cost??????????????????????????? ?$204,000????????? ?$250,000?????????? $274,000

Variable cost per unit is constant within this activity range and there is a step up of 10% in the total fixed costs when the activity level exceeds 11,000 units.What is the total cost at an activity level of 10,000 units?

A firm has to pay a $0.50 per unit royalty to the inventor of a device which it manufactures and sells. How would the royalty charge be classified in the firm's accounts?

Which of the following can be included when valuing inventory?

(i) Direct material

(ii) Direct labour

(iii) Administration costs

(iv) Production overheads

Which of the following is usually classed as a step cost?

Which of the following is not a cost objects?

Which of the following describes depreciation of fixtures?