快速查題-ACCA英國注冊會計師試題

- 不限題型

- 不定項選擇題

- 單選題

- 填空題

- 材料題

- 簡答題

- 論述題

?ABC is not a system that is suitable for use by service organisations.

?Are the following statements about Activity Based Costing (ABC) true or false??

?In a system of ABC, there is no under- or over-absorption of overheads.?

Are the following statements about Activity Based Costing (ABC) true or false??

?In a system of ABC, a larger proportion of overheads is attributed to?low volume products than in a traditional absorption costing system.?

?The following statements have been made about activity-based costing.?

(1) Unlike traditional absorption costing, ABC identifies variable overhead costs for allocation to?product costs.??

(2) ABC can be used as an information source for budget planning based on activity rather than?incremental budgeting.?

Which of the above statements is/are true??

Which THREE of the following statements about activity-based costing are correct??

(1) Implementation of ABC is unlikely to be cost-effective when variable production costs are a?low proportion of total production costs.?

(2) In a system of ABC, for costs that vary with production levels, the most suitable cost driver?is likely to be direct labour hours or machine hours.?

(3) Activity based costs are not the same as relevant costs for the purpose of short-run?decision making.?

(4) Activity based costing is a form of absorption costing.?

Which of the following statements about activity based costing are true??

?The following statements have been made about traditional absorption costing and activity based costing.?

(1) Traditional absorption costing may be used to set prices for products, but activity based costing may?not.??

(2) Traditional absorption costing tends to allocate too many overhead costs to low-volume products and?not enough overheads to high-volume products.??

(3) Implementing ABC is expensive and time consuming?

Which of the above statements is/are true??

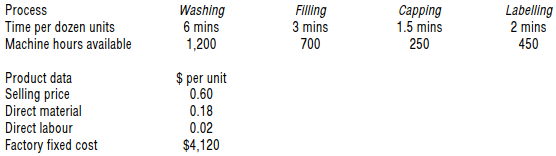

The following data refers to a soft drinks manufacturing company that passes its product through four?processes and is currently operating at optimal capacity.?

Which process is the bottleneck??

?In which of the following ways might financial returns be improved over the life cycle of a product??

1. Maximising the time to market?

2. Minimising the breakeven time?

3. Maximising the length of the life cycle?

In material flow cost accounting (MFCA), input manufacturing costs are categorised into material costs,?waste treatment costs and which of the following??