快速查題-ACCA英國注冊會計(jì)師試題

- 不限題型

- 不定項(xiàng)選擇題

- 單選題

- 填空題

- 材料題

- 簡答題

- 論述題

?Fill in the blank.?

The ………………. price is the price at which an organisation will break even if it undertakes particular?work.?

?Choose the correct word from those highlighted.?

Market skimming/penetration pricing should be used if an organisation wishes to discourage new?entrants into a market.?

A product has the following costs.??

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?$

Direct materials? ? ? ? ? ? ? ? ? ? ? ? ? ?8?

Direct labour? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?10?

Variable overheads? ? ? ? ? ? ? ? ? ? ?4?

Fixed overheads are $15,000 per month. Budgeted sales per month as 500 units??

What is the profit mark up (the nearest whole percentage) which needs to be added to marginal?cost to establish a selling price that will allow the product to breakeven??

?A company currently sells a product for $60 and at this price, demand is 20,000 units per month. It?has been estimated that for every $2 increase or reduction in the price, monthly demand will fall or?increase by 1,000 units.??

What is the formula for the demand curve for this product??

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version?of the exam they are taking.?

The following price and demand combinations have been given:?

P1 = 400, Q1 = 5,000?

P2 = 380, Q2 = 5,500?

The variable cost is a constant $80 per unit and fixed costs are $600,000 pa. The optimal?price is:?

【論述題】

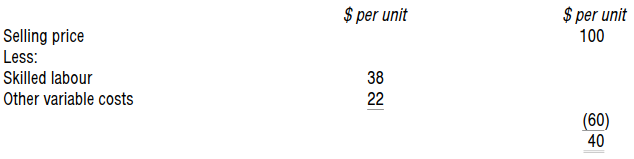

Prepare, on a relevant cost basis, the lowest cost estimate that could be used as the basis for a quotation.?

In order to utilise some spare capacity, K is preparing a quotation for a special order which?requires 2,000 kgs of material J.??

K has 800 kgs of material J in inventory (original cost $7.00 per kg). Material J is used in the?company’s main product L. Each unit of L uses 5 kgs of material J and, based on an input?value of $7.00 per kg of J, each unit of L yields a contribution of $10.00.?

?The resale value of material J is $5.50 per kg. The present replacement price of material J is?$8.00 per kg. Material J is readily available in the market.?

What is the relevant cost of the 2,000 kgs of material J to be included in the quotation??

?A company is calculating the relevant cost of the material to be used on a particular?contract. The contract requires 4,200 kgs of material H and this can be bought for $6.30 per?kg. The company bought 10,000 kgs of material H some time ago when it paid $4.50 per kg.?Currently 3,700 kgs of this remains in inventory.? The inventory of material H could be sold?for $3.20 per kg.??

The company has no other use for material H other than on this contract, but it could?modify it at a cost of $3.70 per kg and use it as a substitute for material J.? Material J is?regularly used by the company and can be bought for $7.50 per kg.?

What is the relevant cost of the material for the contract??

Ace Limited is considering a new project that will require the use of a currently idle?machine. The machine has a current book value of $12,000 and a potential disposal value of?$10,500 (before $200 disposal costs) and hence has been under depreciated by $1,500 over?its life to date.? If the machine is to be fit for purpose on the new project it will have to be?relocated at a cost of $500 and refitted at a further cost of $800.??

What is the relevant cost of using the machine on the new project??

?Blunt is considering a new project but is unsure how much overhead to include in the?calculations to help him decide whether or not to proceed. Existing fixed overheads are?absorbed at the rate of $8 per hour worked.? Blunt is certain that the project will involve an?incremental 500 labour hours.??

The project will involve extra machine running costs and these variable overheads cost him?$4 per hour. The number of extra machine hours is expected to be 450 hours. The?difference between this figure and the 500 labour hours above is expected idle time.??

The project will require a little more temporary space that can be rented at a fixed cost of?$1,200 for the period of hire. This overhead is not included in the fixed overhead?absorption rate above.?

What is the overhead to be charged against the project decision??