快速查題-ACCA英國注冊(cè)會(huì)計(jì)師試題

- 不限題型

- 不定項(xiàng)選擇題

- 單選題

- 填空題

- 材料題

- 簡(jiǎn)答題

- 論述題

?A company can choose from four mutually exclusive investment projects. The return on the project?will depend on market conditions.?

The table below details the returns for each possible outcome:??

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? A? ? ? ? ? ? ? ? ? ? ? ?B? ? ? ? ? ? ? ? ? ? ? ? C? ? ? ? ? ? ? ? ? ? ? ?D?

Poor? ? ? ? ? ? ? ? ? ? ? ? ? ?$400,000? ? ? ? $700,000? ? ? ? ? ?$450,000? ? ? ? ?$360,000?

Average? ? ? ? ? ? ? ? ? ? ?$470,000? ? ? ? ?$550,000? ? ? ? ? ?$500,000? ? ? ? ?$400,000?

Good? ? ? ? ? ? ? ? ? ? ? ? ? $600,000? ? ? ? $300,000? ? ? ? ? ? $800,000? ? ? ? ?$550,000?

If the company applies the maximin rule it will invest in:?

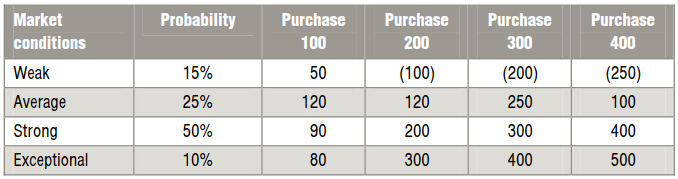

A supplier will supply company B in batches of 100 units, but daily demand is unpredictable.?Company B has prepared a payoff table to reflect the expected profits if different quantities are?purchased and in differing market demand conditions.? ?

????????If the maximax criteria is applied, how many units would be purchased from the supplier??

????????If the maximax criteria is applied, how many units would be purchased from the supplier??

?This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version?of the exam they are taking.??Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses.?There are three grades of truck, the A series, B series and the C series. The uncertainty?faced is the expected growth in the on-line market it serves, which could grow at 15%, 30%?or even 40% in the next period.? ?Shuffles has correctly produced the following decision table and has calculated the average?daily contribution gained from each combination of truck and growth assumption.? ?

Which truck would the pessimistic buyer purchase? Enter only the letter:?

Which truck would the pessimistic buyer purchase? Enter only the letter:?

?This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version?of the exam they are taking.?Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses.??There are three grades of truck, the A series, B series and the C series. The uncertainty?faced is the expected growth in the on-line market it serves, which could grow at 15%, 30%?or even 40% in the next period.? ?Shuffles has correctly produced the following decision table and has calculated the average?daily contribution gained from each combination of truck and growth assumption.? ?

???????Which truck would the optimistic buyer purchase? Enter only the letter:?

???????Which truck would the optimistic buyer purchase? Enter only the letter:?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version?of the exam they are taking.?Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses.??There are three grades of truck, the A series, B series and the C series. The uncertainty?faced is the expected growth in the on-line market it serves, which could grow at 15%, 30%?or even 40% in the next period.?Shuffles has correctly produced the following decision table and has calculated the average?daily contribution gained from each combination of truck and growth assumption.? ?

Based upon the scenario information, if the buyer was prone to regretting decisions that?have been made which truck would the buyer purchase?? Enter only the letter:?

Based upon the scenario information, if the buyer was prone to regretting decisions that?have been made which truck would the buyer purchase?? Enter only the letter:?

?This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version?of the exam they are taking.?Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses.??There are three grades of truck, the A series, B series and the C series. The uncertainty?faced is the expected growth in the on-line market it serves, which could grow at 15%, 30%?or even 40% in the next period.? ?Shuffles has correctly produced the following decision table and has calculated the average?daily contribution gained from each combination of truck and growth assumption.? ?

Based upon the scenario information, if the probabilities of the given growth rates are?15%: 0.4, 30%: 0.25 and 40%: 0.35, which truck would the risk-neutral buyer purchase??

A manager has to choose between mutually exclusive options C and D and the probable outcomes of each?option are as follows.?

Both options will produce an income of $30,000. Which should be chosen, on the basis of the expected?value decision rule??

Fill in the blanks.?

(a) Maximin decision rule: choosing the alternative that …………….….... the ……...….……………..

(b) Minimax decision rule: choosing the alternative that ……………….… the …….….……………....?

(c) Maximax decision rule: choosing the alternative that …….…………… the………...……………...?

(d) Minimin decision rule: choosing the alternative that ……….………….. the…......…………………?

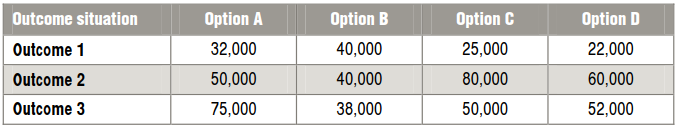

?The following pay-off table shows the monthly contribution that would be earned from each of four?mutually exclusive options (options A-D) given three different outcome situations. It is not possible?to predict or estimate the probability of each outcome scenario.?

If the choice of option is made on the basis of the minimax regret criterion, which option will be?selected??

?Match the type of investor to the attitude to risk:

Risk averse? ? ? ? ? ? ? (i) Minimax regret? ? ? ? ? ? ? ? ? ? ? ? ? (ii) Relevant costing??

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (iii) Perfect information? ? ? ? ? ? ? ? (iv) Maximin??

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (v) Maximax? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ??(iv) Expected values?

Risk seeker? ? ? ? ? ? ??(i) Minimax regret? ? ? ? ? ? ? ? ? ? ? ? ?(ii) Relevant costing?

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (iii) Perfect information? ? ? ? ? ? ? ? (iv) Maximin?

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (v) Maximax? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (iv) Expected values?

Risk neutral? ? ? ? ? ? ??(i) Minimax regret? ? ? ? ? ? ? ? ? ? ? ? ? (ii) Relevant costing??

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (iii) Perfect information? ? ? ? ? ? ? ? (iv) Maximin?

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? (v) Maximax? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?? ?(iv) Expected values?